"How to Start a Bookkeeping Business: A Comprehensive Guide to Starting and Expanding Your Bookkeeping Business" by Brett Philips CPA, empowers aspiring and established bookkeepers to build thriving firms. This guide goes beyond technical skills, providing a strategic roadmap for success. Learn to craft a solid business plan, secure funding, master client acquisition, and systematize workflows for efficiency and profitability. From choosing a business entity and pricing services competitively to managing finances, marketing effectively, and navigating the sales cycle, this book equips you with the tools to build a scalable and rewarding business. Achieve financial security, work on your terms, and help other businesses thrive – your journey to entrepreneurial success begins here.

Review How to Start a Bookkeeping Business

This book, "How to Start a Bookkeeping Business," isn't just another guide; it's a genuine roadmap to entrepreneurial success in the bookkeeping world. From the very first page, Brett Philips CPA’s expertise shines through. It's clear he's not just regurgitating theory; he's sharing hard-won, practical wisdom gleaned from real-world experience. The friendly and approachable tone makes the potentially daunting task of launching a business feel achievable, even exciting.

What truly impressed me was the comprehensive nature of the guide. It doesn't shy away from the nitty-gritty details, covering everything from crafting a solid business plan and choosing the right legal structure to mastering crucial software, setting competitive rates, and building a robust marketing strategy. I particularly appreciated the detailed breakdown of startup costs—a crucial element often overlooked in less thorough guides. This level of detail helped me to realistically assess the potential challenges and formulate a concrete plan. Knowing exactly what to expect, financially and otherwise, is invaluable.

The sections on scaling and growth were especially insightful. Many business guides focus solely on the initial launch, leaving entrepreneurs floundering once they achieve a certain level of success. This book doesn't fall into that trap. It offers clear, actionable strategies for managing growth, handling expanding client bases, and maintaining profitability as your business flourishes. It's a testament to the author's understanding of the entire business lifecycle.

Beyond the practical advice, the book also offers invaluable guidance on managing client relationships, a crucial aspect of any successful bookkeeping business. The tips on creating efficient workflows and systems for managing clients felt incredibly relevant and immediately applicable. This isn't just about the technical side of bookkeeping; it's about building a sustainable and thriving business.

I found the chapters on marketing and client acquisition particularly helpful. The author provides concrete, actionable strategies, rather than vague suggestions, which are easy to implement. The book doesn't sugarcoat the challenges; it acknowledges the hard work involved but empowers the reader with the tools and knowledge to navigate them successfully. It's empowering to know you have a detailed plan to address potential setbacks, instead of just hoping for the best.

The author's experience as a CPA is evident throughout. The advice on financial management, tax compliance, and interpreting financial statements is both thorough and understandable, even for those without a strong accounting background. This book goes beyond just the technical aspects; it instills confidence and provides a clear path to navigating the complexities of running a bookkeeping business. If you're considering starting your own bookkeeping business, or even looking to elevate an existing one, this book is an absolute must-read. It's an investment in your future success, and it's one I wholeheartedly recommend.

Information

- Dimensions: 7.5 x 0.58 x 9.25 inches

- Language: English

- Print length: 255

- Publication date: 2024

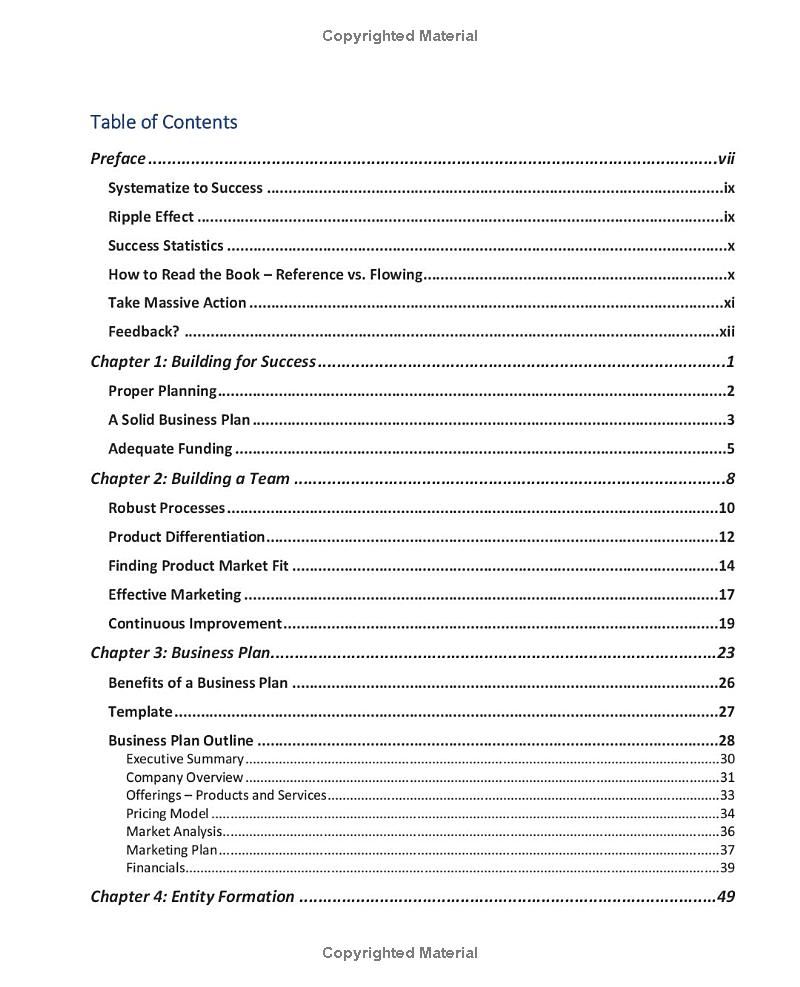

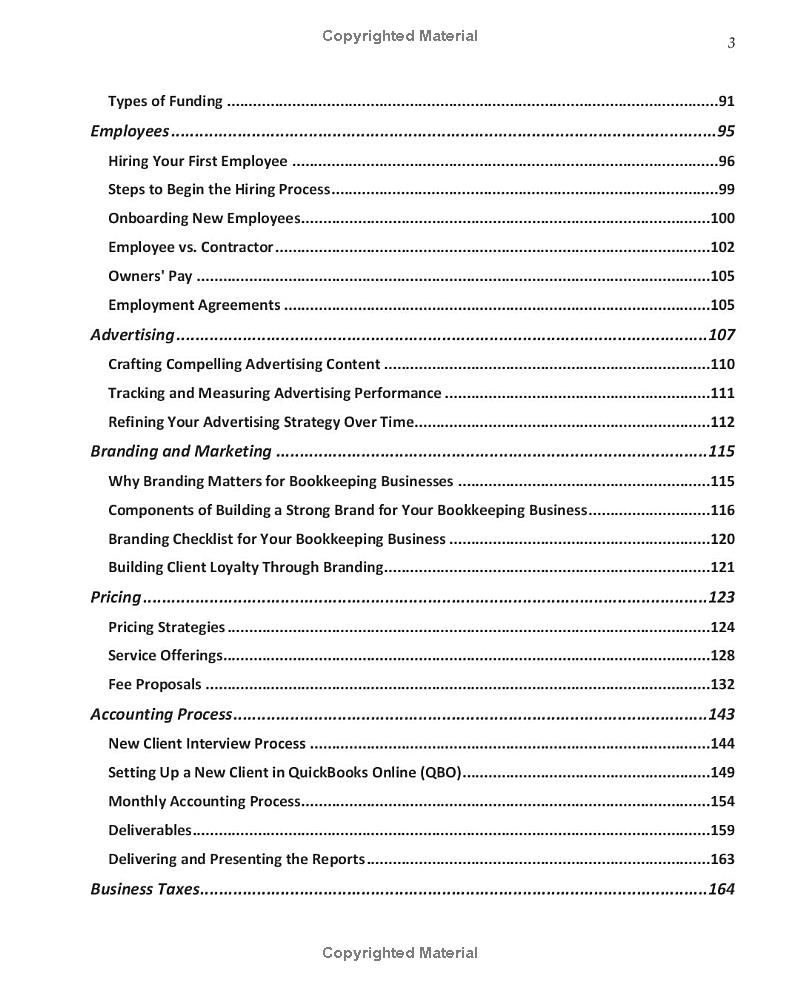

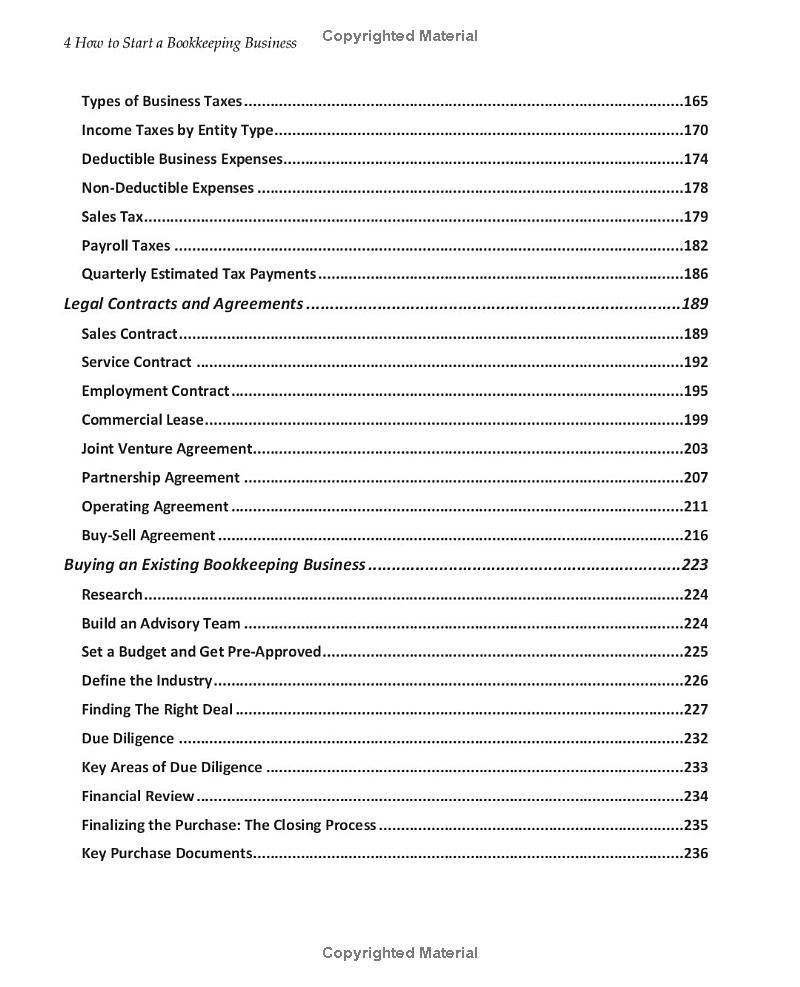

Book table of contents

- Preface

- Chapter 1: Building for Success

- Chapter 2: Building a Team

- Chapter 3: Business Plan

- Chapter 4: Entity Formation

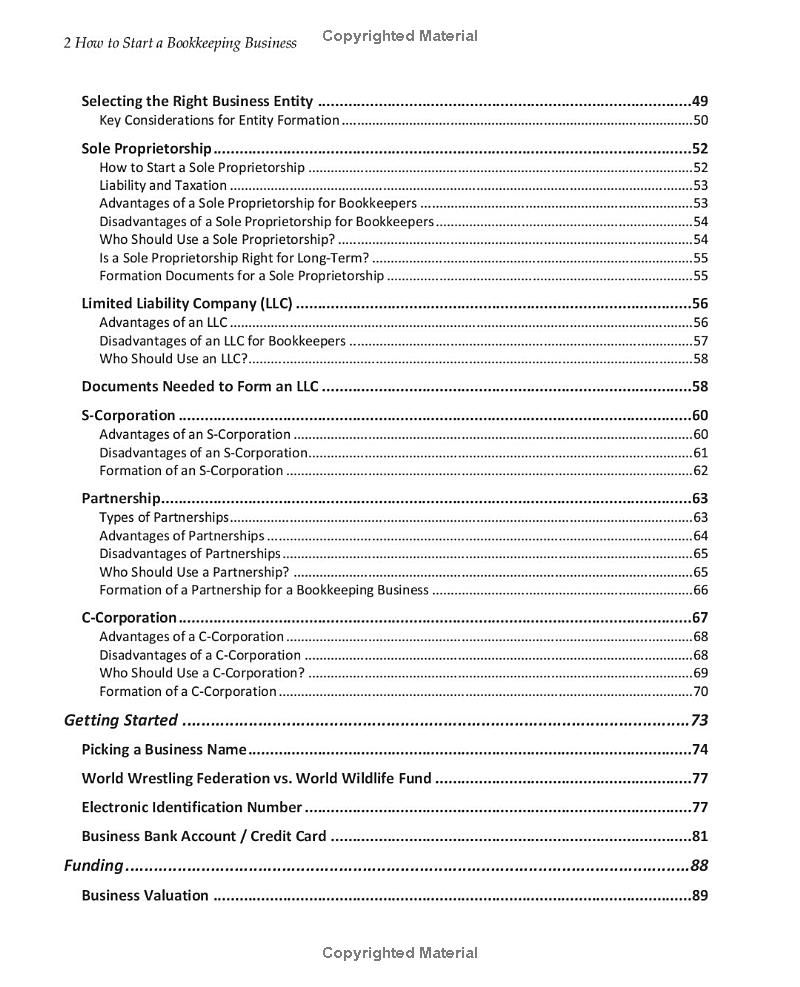

- Selecting the Right Business Entity

- Sole Proprietorship

- Limited Liability Company (LLC)

- S-Corporation

- Partnership

- C-Corporation

- Getting Started

- Types of Funding

- Hiring Your First Employee

- Onboarding New Employees

Preview Book